Blog

Blog

April, 2023

The Overlap between VC and Climate

Our previous blog post described the tailwinds driving the opportunity in Climate tech and why we think this time is different from Cleantech 1.0. Now, we would like to focus on the bottom-up case for climate investing, or in other words – where do climate and VC overlap?

While the top-down thesis for climate tech makes a lot of sense, the bottom-up thesis per company is challenging. Since climate is a physical problem, most companies include hardware, require large amounts of capital, and have less familiar exit paths. Not the ideal sweet spot for VCs.

So, we analyzed our portfolio funds’ investment in climate, and in parallel, we developed a high-level framework to help us understand where VC funds should “play” when it comes to climate.

Observations from Vintage’s U.S. and EU Funds’ climate investments

Leveraging Vintage’s unique exposure via our fund of funds’ database, we first mapped out climate-related investment among our U.S. and European Funds from this last decade (2012-3Q 2022). Wondering what lessons we could draw from their investment decisions, we focused on sub-sectors, amount and pace, follow-on funding, and hardware vs. software.

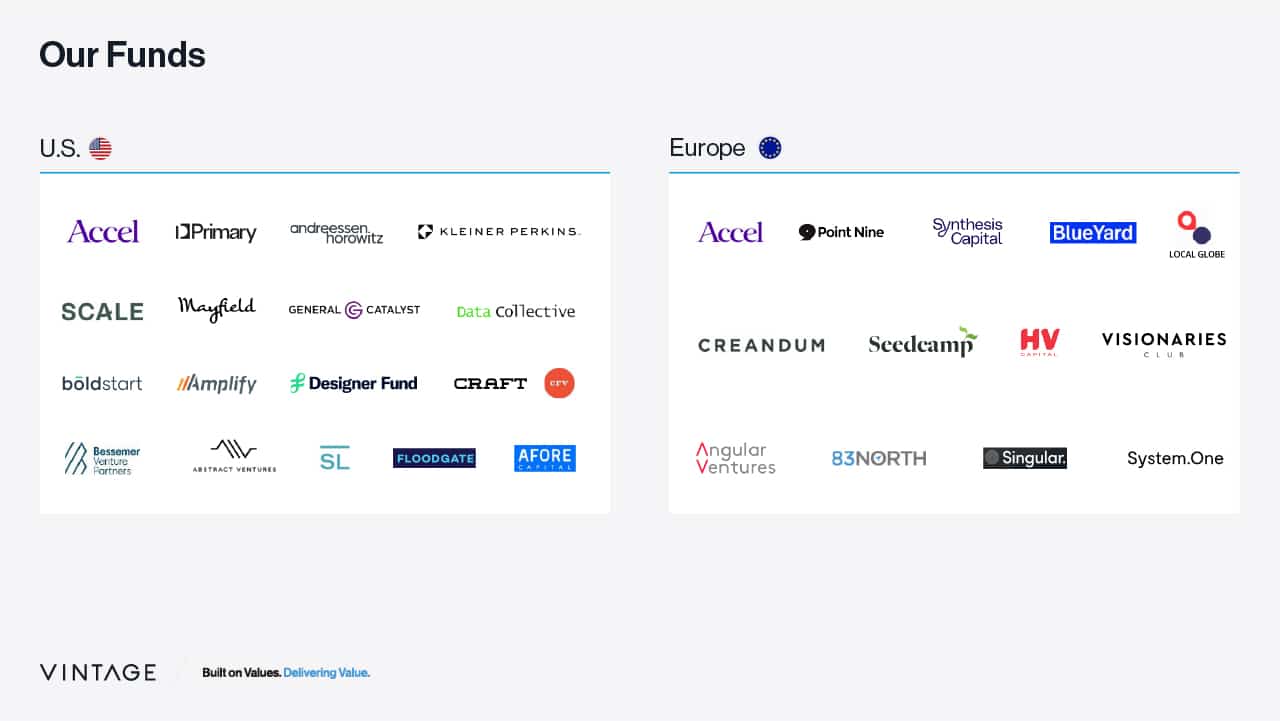

Our analysis is comprised of 31 GPs: 18 from the U.S.[1] (35% of our total U.S. funds, 46% of $ committed during this period), and 13 from Europe (81% of total European funds, 88% of $ committed during this period), with “climate-related companies” defined as any company whose main product directly supports or assists mitigation or adaptation related to climate challenges.

Here is the list of funds we analyzed:

Observation #1: While only 2% of total investments in the past decade were in climate companies, almost all these funds invested in at least 1 climate company.

Out of ~5,000 investments in the last decade by the funds mentioned above, we found only 117 investment rounds in 106 climate-related companies (~2% of the total number of companies). All European GPs had at least one climate investment, and 15 of 18 U.S. GPs made at least one climate investment.

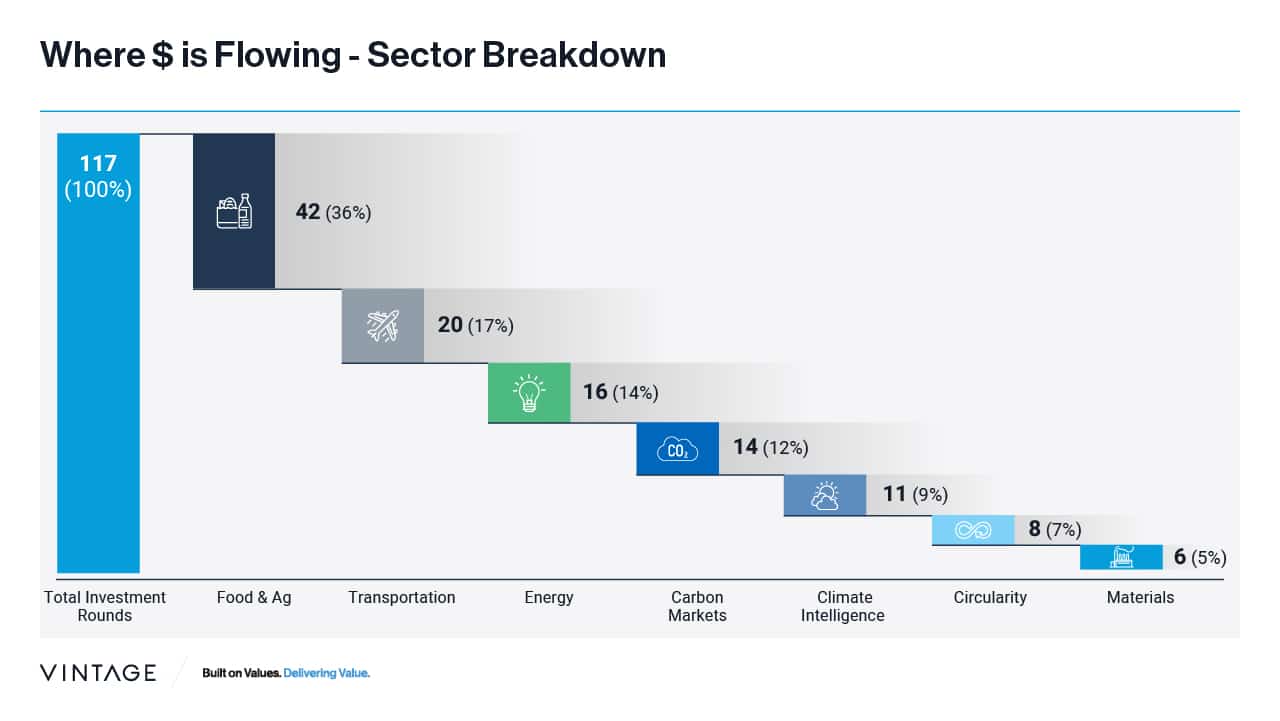

Observation #2: Leading sectors were Food & Agriculture, Transportation, and Energy

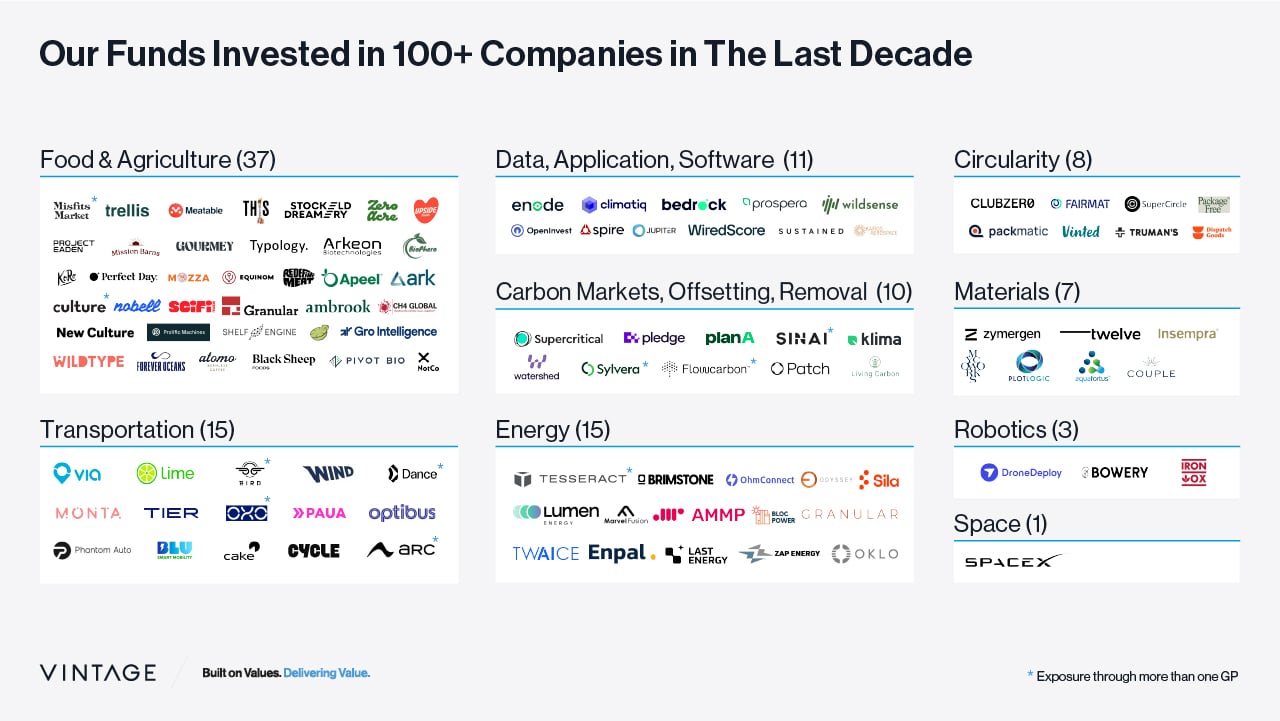

All 106 companies fall into seven main categories: Food & Agriculture, Transportation, Energy, Climate Intelligence, Circularity, Materials, and Carbon (markets, offsetting, removal), as shown below.

Observation #3: Food and Agriculture was the biggest sector, and Carbon was the fastest-growing one

Food & Agriculture, and Transportation, were the most active sectors, accounting for 53% of total investments. Despite being capital-intensive and involving hardware, these sectors have not deterred investors. Notably, the emerging sector of Carbon (including markets, offsetting, and removal) has seen rapid growth, with 14 investments made since 2H 2019.

Observation #4: Investments are local, although Israel was the exception for U.S. and European Funds

Local investments were preferred by U.S. and European managers, with approximately 90% of investments made by U.S. GPs and 75% made by European GPs in their local geographies. This makes a lot of sense since the majority of investments are early stage, and those tend to be in local markets. Israel has captured the attention of global investors as it was the only non-U.S. geography where European managers invested in. Similarly, with U.S. managers, Israel was the only geography to receive more than one investment.

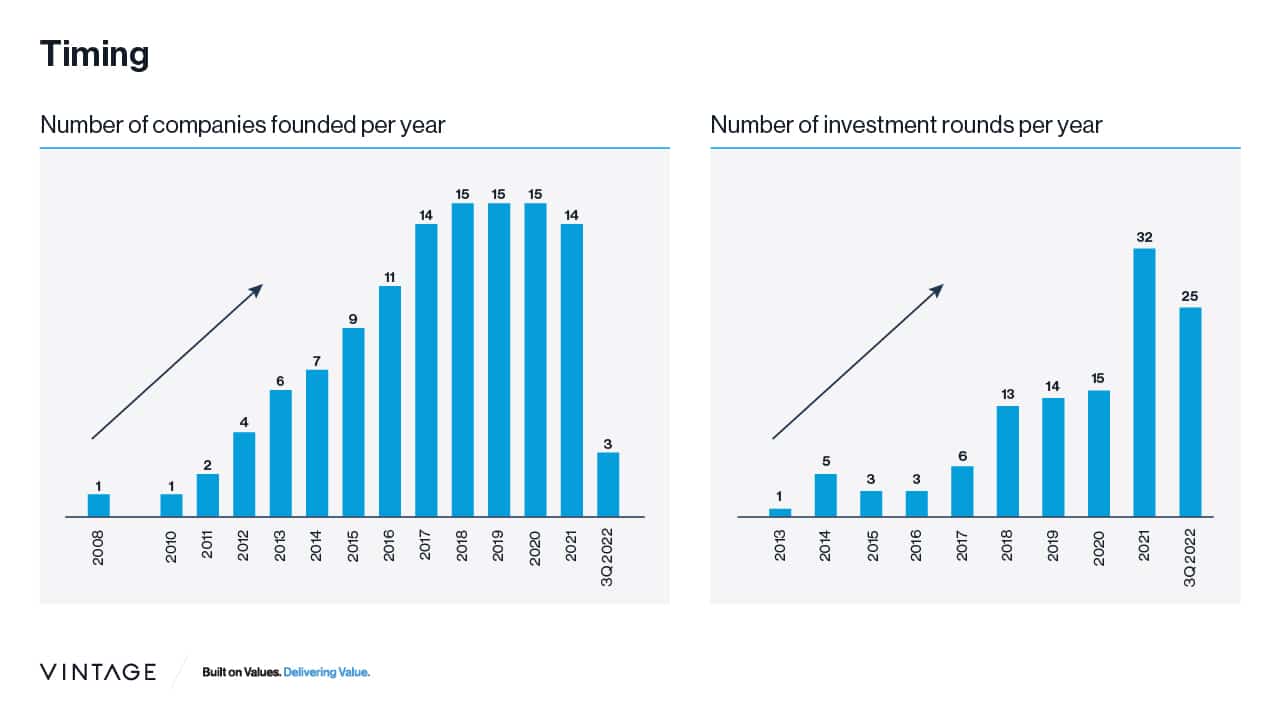

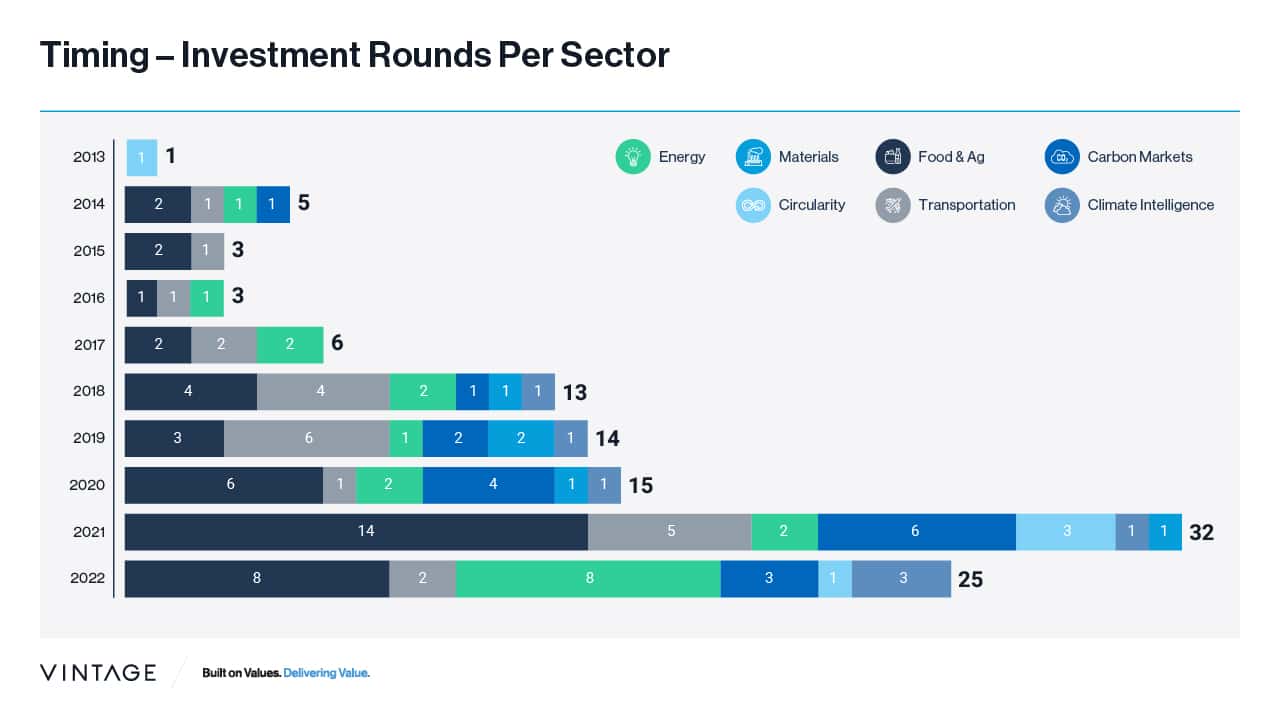

Observation #5: Dramatic increase in the pace of founding and funding climate companies

The urgency to address climate change and additional tailwinds such as regulation and government funding have resulted in a significant shift in the mindset of founders and investors alike. Over 80% of companies were founded after 2014, with 40% after 2018, suggesting that an increasing number of founders are prioritizing climate-related problems. Investors are also taking the same route, with more than 50% of investments made during 2021-2022. The investment pace in 2021 was over 2x! Compared to 2020, and it remained steady in 2022, unlike other sectors that dropped more sharply.

Observation #6: Each sub-sector has its own pace

Over the last two years, generalist funds have placed greater emphasis on investments in Food & Agriculture, Energy, and Carbon, where we are witnessing a growing number of investments over time. However, investments in Transportation, Circularity, Materials, and Climate Intelligence have remained sporadic and acyclic to others.

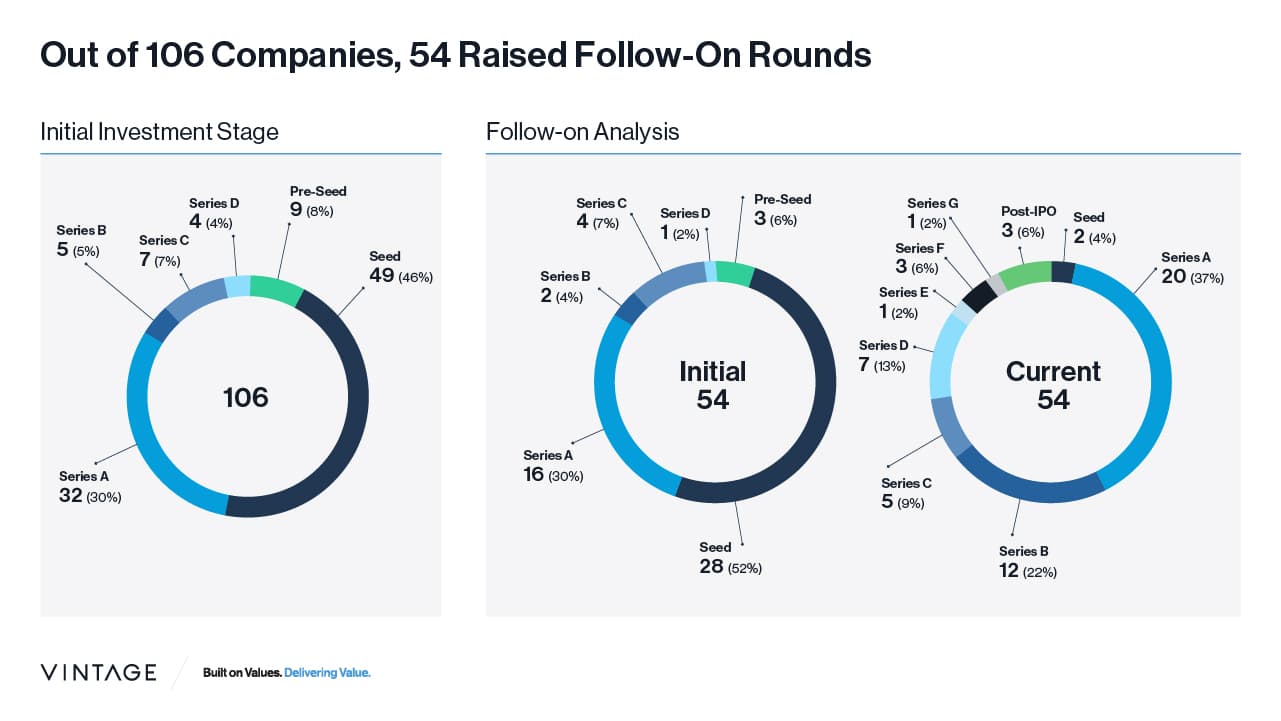

Observation #7: Most investments are early-stage, with half raising follow-ons thus far

Since the ecosystem is young, Pre-seed/Seed investments accounted for 55% of initial investments, while Series A accounted for 30%, and Series B+ made up only 15%. Out of the 106 companies, half (54) successfully raised follow-on rounds. 87% of those 54 companies were pre-seed to Series A investments at the initial investment stage, while currently, 60% of them are in Series B or beyond.[2]

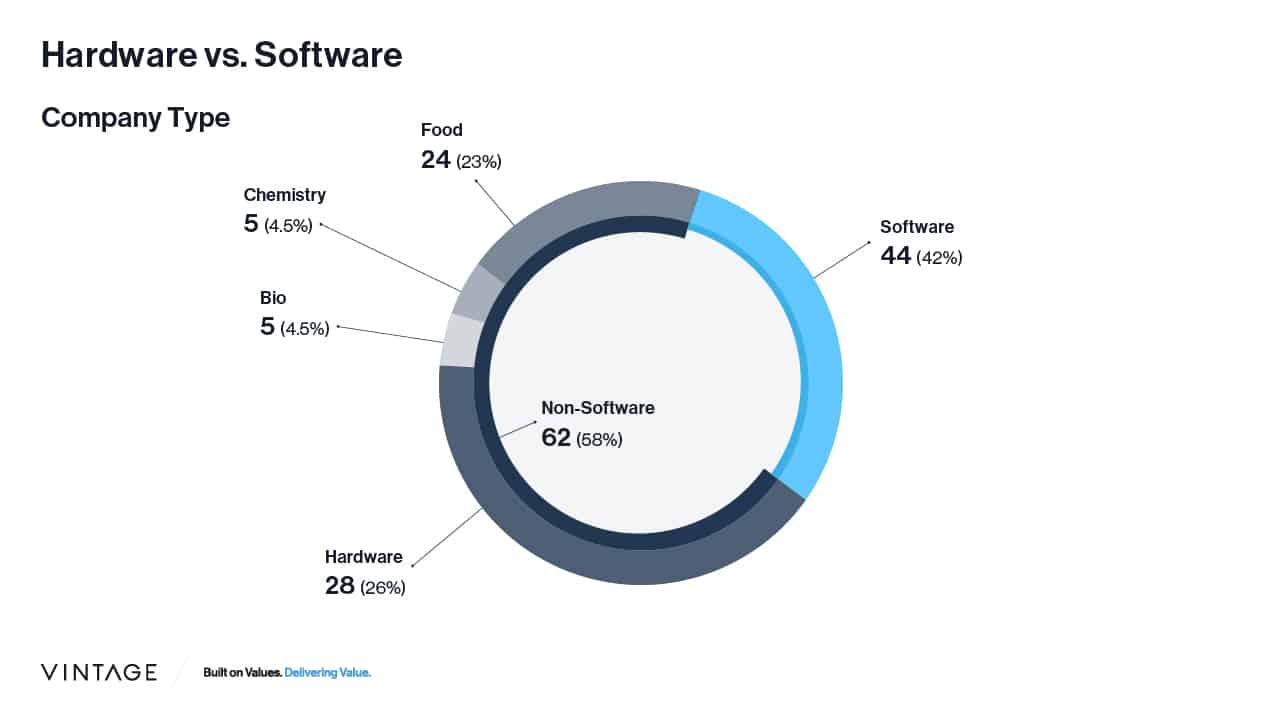

Observation #8: More than 50% of companies are not software

Surprisingly, generalists are making most of their investments in non-software companies when it comes to climate. Out of the total investments made, 42% were directed towards software, 30% towards hardware, and the remaining 28% were allocated to fields such as Food, Chemistry, or Bio, which we classified as “other.”

So, where do Climate and VC Overlap?

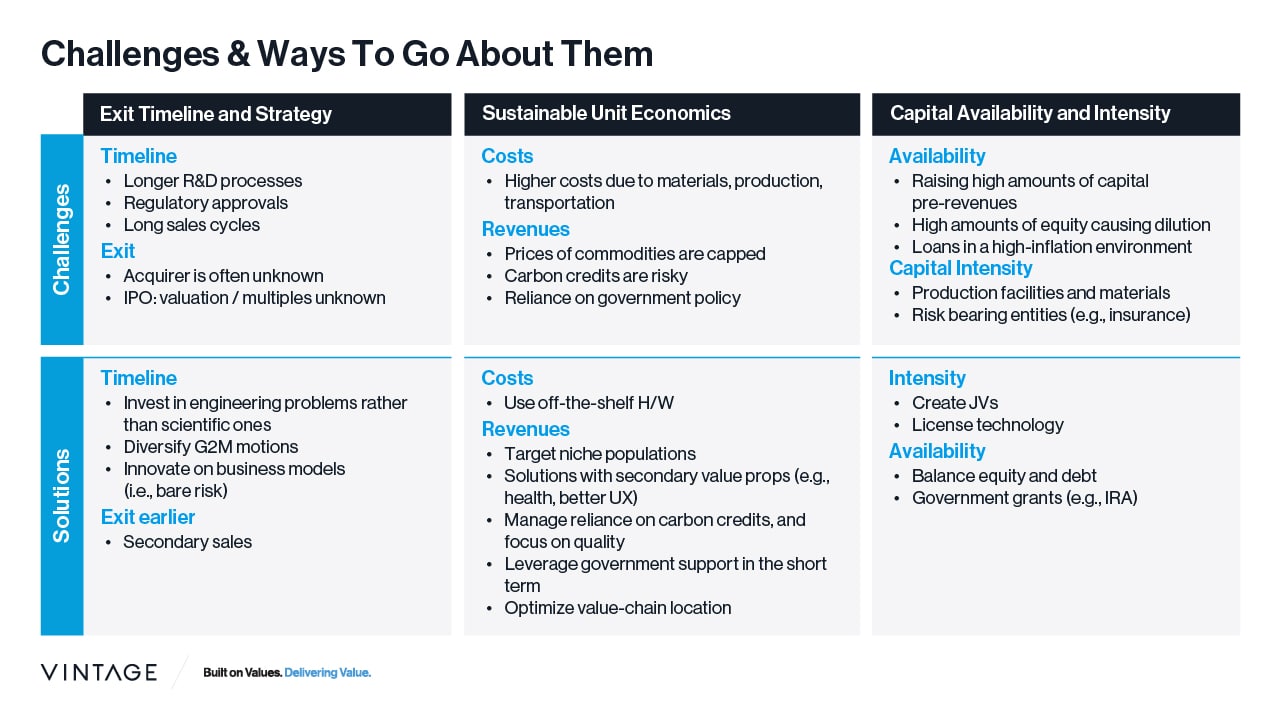

Given the situation in our portfolio and following multiple conversations with our funds, we mapped out the main challenges from a VC perspective and categorized them under three sections: (1) Exit Timeline and Strategy, (2) Sustainable Unit Economics, and (3) Capital Availability and Intensity.

(1) Exit Timeline and Strategy

The successful VC model usually requires a roughly 8-12-year timeline from investment to exit. In this period, companies are required to develop their product, sell it, and scale the business to an IPO, usually when the company reaches several hundred million dollars in revenues and is profitable or nearing profitability (of course M&As may happen at any point, but are not the outcome the best VCs are aiming for). However, climate investing often takes longer, while uncertainty is higher. Physical solutions require hardware, biological or chemical innovation, resulting in longer development times and cumbersome regulatory approval journeys. Once the product is finally ready, it is most likely be sold to governments, energy or water utilities, and legacy industrial players (e.g., steel and cement makers, airliners, automakers, CPGs, agriculture conglomerates, etc.) – and it might take a lot of time to sell to these folks. Once you finally get the product and commercialization parts right (slowly but surely), it is often unclear who will acquire the company or at which multiple it will be able to IPO. Altogether, there are concerns about the potential IRRs of climate investments.

(2) Sustainable Unit Economics

One of the most important parameters for a healthy business is its unit economics. Simply put, what are the building blocks to ensure revenues remain higher than costs on a unit level? Physical solutions are associated with higher costs since they include materials, production, transportation, etc., especially when compared to software, which primarily includes cloud costs and people. On the revenues front, since climate tech targets disrupting traditional economies, we often talk about creating alternatives to commodities such as energy, food, cement, steel, and plastics. The willingness to pay “green premiums” for such products is usually low. Finally, an essential mechanism in the current climate story is the option to internalize externalities in the form of carbon taxes and/or carbon credits. While both hold a big promise, carbon taxes = reliance on government policy, and carbon credits are unstable and yet to be proven.

(3) Capital Availability and Intensity

As noted earlier, climate companies that produce physical goods are likely to be capital intensive, as they need to finance production facilities and pay for materials and their transport. In addition, risk-bearing companies such as climate insurance providers may also be capital-intensive. This entails raising significant funding rounds often early in their lives, which is not easy to raise – especially pre-revenues and even more so in the current downturn environment. If raised successfully, equity will further dilute existing shareholders, and debt in the current inflation environment is not cheap and may not even be available.

These challenges make many generalist VCs shy away from most climate opportunities and focus on what they know best – software investing. We’d like to challenge this thesis by offering solutions to the challenges above and by stressing the potential of non-software investing.

How can these challenges be overcome?

(1) Exit Timeline and Strategy

There are two ways to reduce the time to exit – either make sure a company’s journey fits the VC timeline or sell earlier. As our colleagues at Bessemer pointed out in this wonderful piece, there are multiple ways to make things happen quicker: on the R&D front, make sure to invest in engineering problems rather than scientific experiments and focus on identifying inflection points. To that extent, we are seeing more science projects benefiting from non-dilutive grants and academic funding, pushing forward the need to raise equity. With manufacturing, compromise on margins while doing JVs or contract manufacturing, and by doing that, avoid the time and capital it takes to build a new facility. With sales cycles, diversify G2M motions and innovate on business models to bear more risk and make the value proposition more attractive to customers. Here we are witnessing the evolvement of climate-tech buyers such as large tech companies, financial institutions, and even consumers, enabling companies to scale more quickly. Finally, if the journey is taking longer, it is always possible to sell holdings via secondary. There is a chance that – similar to biotech – climate companies will go public earlier and use the public market for financing, but it is TBD.

(2) Sustainable Unit Economics

Here as well, there are two main things to focus on – increase revenues and reduce costs. Revenues-wise, we have seen several interesting plays: target niche populations that are willing to pay higher prices (e.g., Impossible Foods’ burger launch) while bringing cost curves down; offer solutions with secondary value props that customers are willing to pay premiums for much better user experience (e.g., Mill, that offers a household food waste solution that dries food leftovers), labor shortage (e.g., Halter that is redefining cattle herd management) or better health outcomes (e.g., Sensibo, that is building an indoor climate and air quality consumer brand); leverage government support in the form of tax credits or subsidies while developing additional revenue streams in the long term and in terms of carbon credits, try and make sure this is not the only source of income and in any event, focus on creating high-quality credits (e.g., Groundwork Bioag and CarbonCure).

Cost reduction can be done mainly through off-the-shelf hardware that, besides being cheaper, also reduces R&D times. Generally speaking, a company should optimize its location on the value-chain by ensuring it sells to customers willing to pay the highest price while requiring the lowest resources (e.g., B2B fermentation dairy companies such as Perfect Day, Remilk, and ImagineDairy).

(3) Capital Availability and Intensity

Reducing capital intensity early on, while a company is still pre-revenues, is often a must. We have seen companies deal with this issue, for example, through the creation of JVs (N-Drip’s partnership with PepsiCo) and by licensing their technology to other producers. After those companies generate revenues, it is easier for them to raise equity and/or debt and build their own production facilities.

On the capital availability front, it is key for companies to consider alternative financings like debt. We are seeing more and more alternative mechanisms for fundraising, such as Third Sphere, a VC fund that offers credit such as revenue-based finance or off-balance sheet leasing that take advantage of government incentives (e.g., IRA), and Breakthrough Energy Catalyst, a $1bn vehicle raised from corporates, that provides project finance for climate companies in attractive terms. Additional financing examples include Frontier, an advanced market commitment for carbon credits. We are also seeing the immediate impact of the IRA, which already provided grants to climate startups like Ascend Elements, who were rewarded a $480m grant from the DoE to manufacture sustainable battery cathode active materials.

Pick your spots

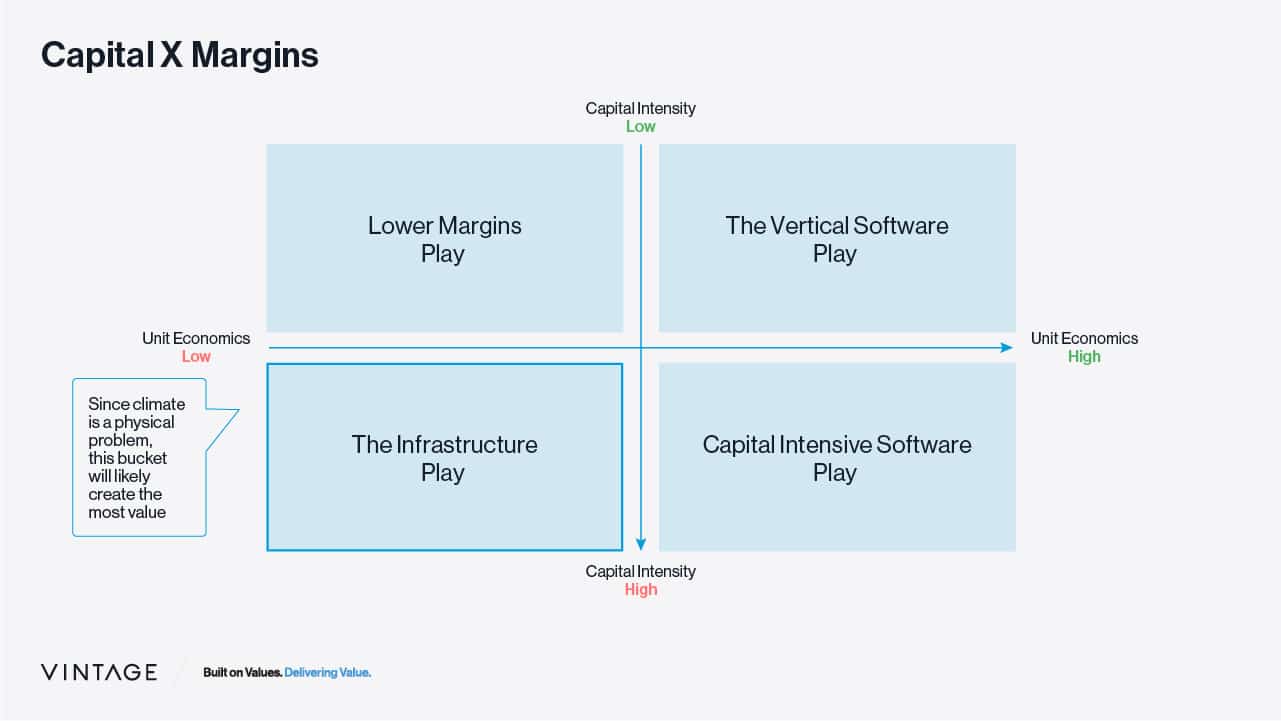

With a clearer picture of climate-related challenges and potential solutions, we created a 2X2 matrix for two of the challenges – sustainable unit economics (higher margins on the right) and capital intensity (lower intensity at the top). This creates the following four buckets:

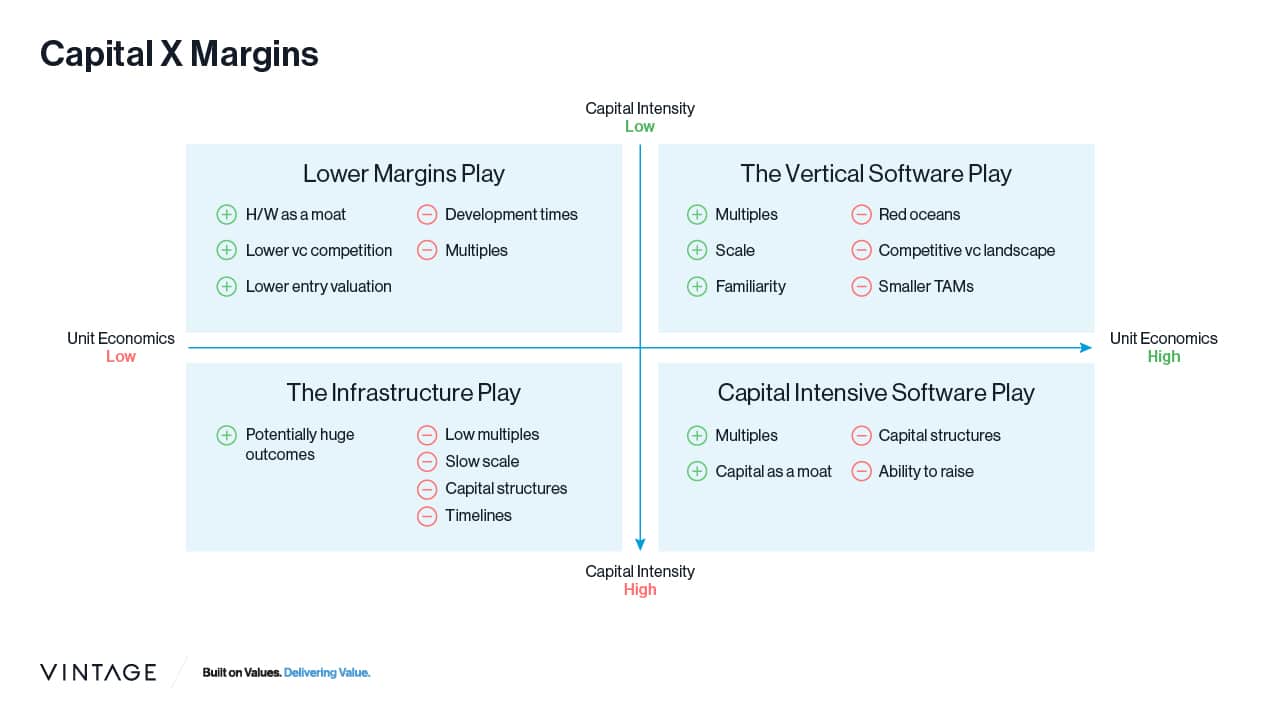

(1) The Vertical Software Play: low capital intensity and favorable unit economics (i.e., high gross margins). This is the most comfortable bucket for generalists as they are most experienced in software investing, and it avoids the aforementioned challenges. However, it is also the most competitive place to play in – this is a red ocean, both in terms of companies and VCs (overvalued carbon accounting companies anyone?). While investing solely in this space is appealing, we think focusing only here will result in missing out on tremendous opportunities.

(2) Capital Intensive Software Play: the best examples include insurance and fintech companies for climate-related purposes. While these opportunities are intensive capital-wise, many VC investors are familiar with such business models and only need to find the right niche market to invest in.

(3) Lower Margins Play: this bucket includes mostly off-the-shelf hardware solutions that reduce margins but at the same time do not require high amounts of capital. While it is easy to pass on any solution involving hardware, we believe many interesting investment opportunities could be found here – because competition is not as fierce, and hardware can serve as a moat.

(4) The Infrastructure Play: or, in other words, the “keep-away” bucket. It is common wisdom for VC investors to shy away from low-margin X capital-intensive plays, and indeed, most of the opportunities in this bucket are not the ideal fit for a typical VC. However, since climate is a physical problem, it requires physical solutions; thus, most value is likely to be created in this bucket, with successful companies going on to become significant players in their industries. Just imagine the next green steel company, a cultured meat conglomerate, or a net-zero airliner. These are the disrupters who will become the incumbents of the next decade.

Summary of pluses and minuses below:

It is important to mention that these buckets are not created equal in the number of companies operating in each, nor in their potential impact.

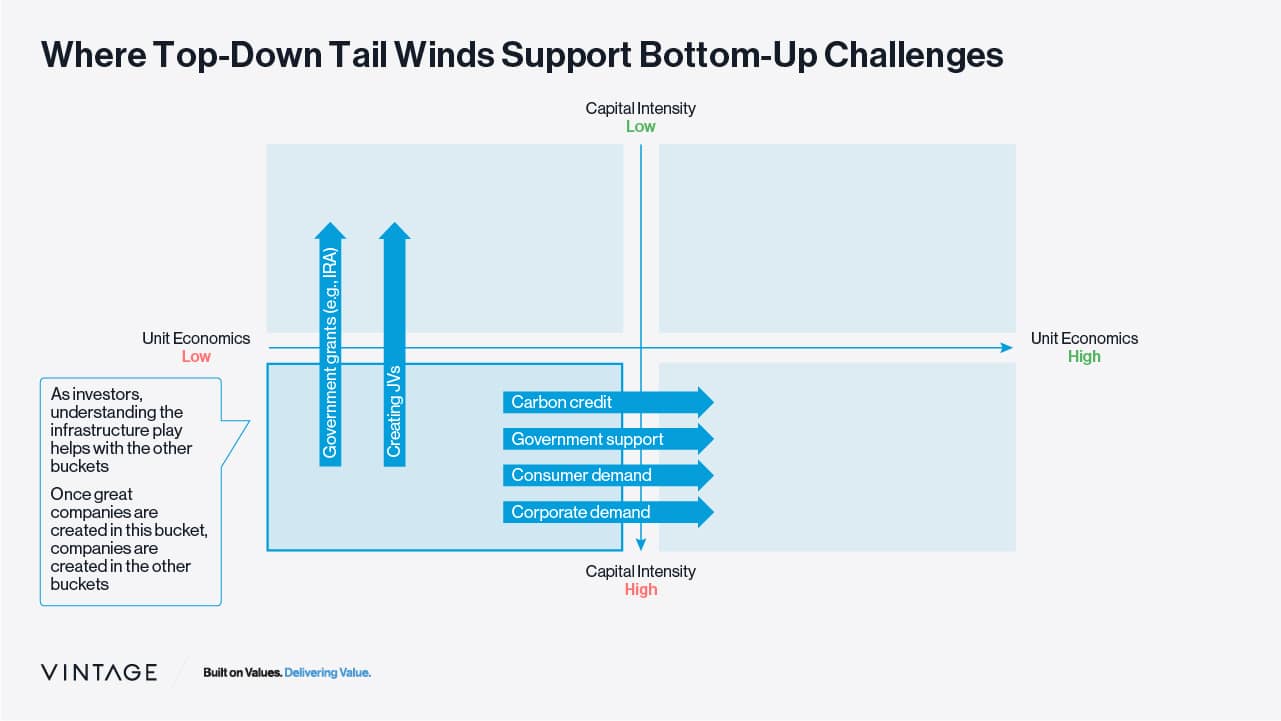

Connecting this to our previous blog post, thanks to the top-down tailwinds we are witnessing in climate, many companies that have been historically considered under the “Infrastructure Play” bucket can shift right to the higher margins zone by leveraging carbon credits, government subsidies, and consumers’ and corporates’ higher demand, as well as enjoy significant cost reductions that occurred in the past decade in solar, wind, batteries, and more. They can also climb up to the lower capital intensity zone by leveraging government grants and creating JVs. This is where the top-down climate thesis meets bottom-up investment opportunities.

Finally, we believe there is value in studying the infrastructure play bucket not only because there might be some exciting opportunities there but also because it helps with understanding the other buckets (e.g., DDing a cultured meat company can help with understanding “bioreactors-as-a-service” companies) and because once-great companies are created in this bucket (e.g., Tesla), the ecosystem matures, and new opportunities are founded in the other buckets as well (e.g., EV charging infrastructure).

We encourage VCs to take a broader view, step out of their comfort zone, and be willing to take risks. Or, in other words, how our Founder and Managing Partner, Alan Feld, framed it – stop with the Me Too investing. Acknowledging the significant tailwinds supporting the development of climate solutions during the subsequent decades, we remain very excited about the space and focus our efforts on partnering with VCs who have developed deep and thoughtful theses about this overlap.

[1] We chose these funds because they represent our U.S. portfolio in terms of size, geography (East, West, Midwest), investment stage, and sector focus.

[2] We chose the earliest entry round in case companies we examined contained exposure through multiple GPs.