Blog

Blog

January, 2022

A couple of weeks ago I presented to a group of Israeli venture capitalists the state of the VC landscape at the end of 2021. This is a presentation that we at Vintage have been presenting for years and have been updating constantly.

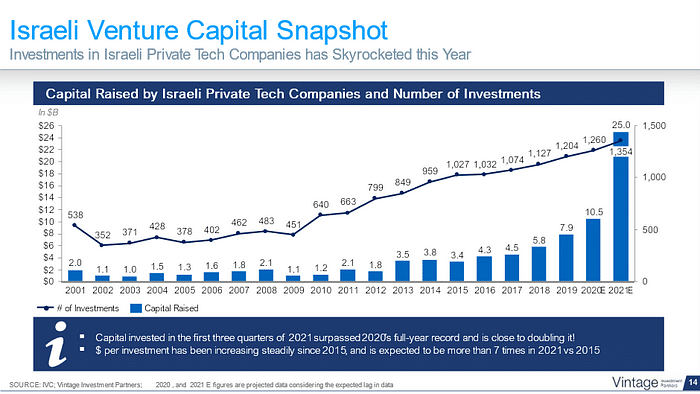

The first insight which was clearly visible is the growth of available capital into Israeli startups as can be seen in the slide below. $25B was invested in Israeli startups in 2021 which is almost 2.5x more than in 2020 (which was a record year despite the Covid-19 outbreak)

While the increase in capital invested has been widely reported, it’s also a good slide to reflect on the supply and demand in the ecosystem. While capital invested has increased by 735% since 2015, the number of private rounds is only up by 32% in the same period. This means significantly more capital has been invested into every round.

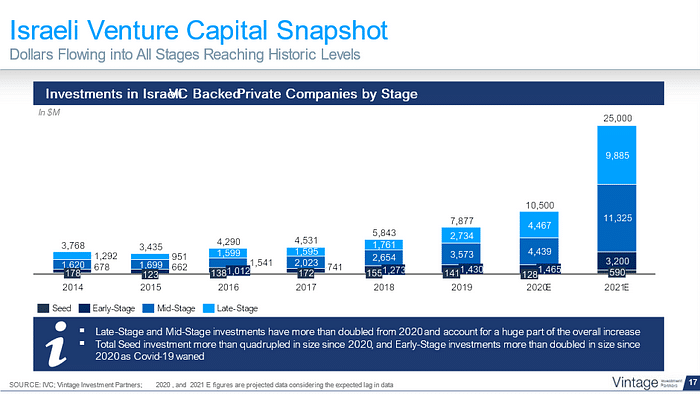

This overall growth in capital in the last few years was also nearly completely driven by increased investments into the mid and later stages which can be seen in the slide below.

Most of the capital coming into the mid and late stages came from international investors. That makes sense, because a) most of those investors didn’t have a local presence and discovered the companies only after they raised one or two rounds and b) most of these funds manage several $B and have to deploy large amounts.

In 2021 this was the case as well. Both mid and late stage more than doubled and accounted for the vast majority of the $25B. However, what struck me this time around when I looked at the data was that for the first time in 2021 there was a significant increase in the earlier stages as well. Annual seed investments ranged from $120M-180M since 2014 until 2020, while series A investments grew steadily from $700M annually to almost $1.5B in 2020. But in 2021 these numbers grew significantly. Seed was up >4x and series A >2x.

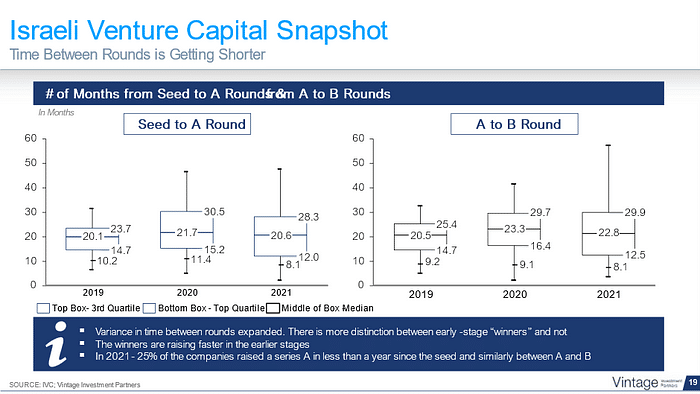

The most visible driver was the growth in the early-stage check size. This past year there were multiple seed rounds of more than $10M and even more than $20M, and series A rounds of tens of millions of dollars, a totally new phenomenon in the Israeli VC market. But the growth in the size of the check is not the only driver, the other one is the pace of investments — companies are raising in faster intervals than before as can be seen in the slide below.

On the left-hand chart, we see how long it took companies between the seed round and the A round. The median in 2019, 2020 and 2021 is very similar ~20–21 months. What’s different is the variance. The box represents the second and the third quartile (in terms of time between rounds), it expanded every year. The length of the line is the total range between the fastest and the slowest time between the seed and the A, it also expanded over the last three years. What this means is that the better perceived companies are raising faster, and the lesser ones take longer to raise. In 2021 a quarter of all series A rounds happened in under 12 months after the seed round, in comparison to 15 months in previous years. The top decile in terms of how fast a company raised, ie. 10% of the rounds occurred in less than 8 months! in 2021 (this is the tick below the box) relative to 10–11+ months in previous years.

One comment I heard when presenting this was that there are companies in which one can see the traction very early on, which might explain the rapid pace of investments into the company. While this might be true, still in most of the seed stage companies this is not the case — at that stage most companies focus on building a product, hiring a team, and finding a few design partners (in B2B for example). Which on average means nothing dramatic has changed in less than a year between the seed and the series A.

What does this mean for seed and for series A?

Seed investors take essentially three risks into account when backing the founding team — the ability to hire a team, the ability to develop a product and the ability to find a large enough need in the market served by the product. In less than a year, many companies can prove some hiring success (although they will also likely turnover many of the early hires), some product progress (and of course the offering will likely morph as well), and very early signs if at all, of serving a market need. And as we’ve seen, the top 25% of the A rounds happen in less than a year… Which means that these days, seed investors that back strong teams don’t really bet very differently than the series A investors. Strong founding teams are most likely to be able to hire great employees, build a first version of the product and acquire design partners and maybe even a few initial customers (in some cases these are companies ran by founders in the same network), hence essentially the main risk of finding a market for the product has most likely not been mitigated at all. And that’s when the series A investors come in with a large check at a significant mark up to the seed round.

The downstream capital that started pouring into Israel in the late and mid stages, mostly by international funds, is now also very active at the early stage. It is therefore not a surprise that seed investors are willing to write faster and larger checks to strong founding teams, as the likelihood of these teams to raise a series A with additional capital at a higher valuation and very soon after the seed round is very high these days.

It will be interesting to follow this trend in 2022.. Happy New Year !