Blog

Blog

August, 2022

During my first 6 months on the investment team at Vintage, I have seen a dramatic shift in the VC market. When I first joined, capital invested and valuations were at an all-time high. I had to remind myself that $X0M seed rounds or $50M-$100M A rounds are not the norm. But this influx of capital wasn’t only in primary investments in venture capital but was also seen in the broader secondary market. In their 2021 Review, Jefferies estimated global secondary volume was $132 billion, up 50% from the prior peak in 2019.

But before we go any further, let’s first understand the basics of secondaries in VC.

Secondaries in VC

Traditional VC investment occurs in the primary market. I as an investor, invest capital directly in a startup and the capital goes on their balance sheet. Depending on when I invest, it can take 10+ years for me to see any returns because the startup needs to scale and exit – either via M&A or an IPO (or in the case of 2021 via SPACs) – before I get liquidity.

But what happens if an investor wants liquidity before an exit event? Or the management team wants to show the real worth of their shares to employees? Or the board wants to reduce the financial pressure on founders to sell early? This is where the secondary market comes into play. Someone who holds an illiquid interest in a startup can receive liquidity by selling all or part of their interest via a secondary transaction based on a price negotiated directly between the buyer and the seller.

Secondaries in 2020-2021 – Access and Capital Deployment

In 2020-2021, when VC capital was at an all-time high, investors found a new avenue to deploy capital and began using secondaries for a new purpose entirely: access and capital deployment.

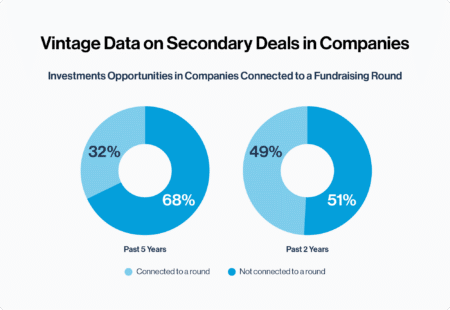

As you can see from Vintage’s data in Exhibit A, the share of fundraising rounds including secondaries went from under 1/3 of all rounds to basically 1 in every 2 rounds relative to the 5 years prior. Investors started using secondaries during competitive rounds to: 1) win deals, 2) gain larger holdings, or 3) for all of the above. For founders, it gave them 1) flexibility to limit dilution, 2) the opportunity to broaden the fundraise to include more investors on their cap tables, 3) the possibility to incentivize employees and 4) ultimately take home some capital themselves.

Exhibit A

However, because the driving force behind these secondaries was access and capital deployment, the balance of power shifted in favor of sellers who could sell their interests at almost no discount, to the current or latest round price. In essence, these secondaries were more similar to primary investments, despite often being for ordinary shares at the bottom of the preference stack.

The influx in VC capital had a similar impact on the appetite for secondaries in VC portfolios themselves, as demonstrated by Lazard’s estimate that in 2020 and 2021, GP-led secondary volume made up 50% of the secondary market. A GP-led secondary is where a GP allows its LPs to sell all or part of their holdings in a VC fund to a third-party buyer. This provides the current LPs with some liquidity and sometimes, allows the new buyer and LPs wishing to remain in the fund, the opportunity to put more capital to work for the purpose of investing in the future rounds of select portfolio companies. In this scenario, the buyer is also typically looking to access high quality companies and participate in the future rounds – in this case via a quality GP.

But how did this phenomenon of access-driven secondaries impact market participants and what will things look like in the current market?

The most notable impact was that founders and investors experienced record-levels of liquidity via less traditional avenues i.e., M&As and IPOs, in an otherwise illiquid market. For founders, they raised larger rounds much faster, received partial liquidity earlier than expected and in many cases, at higher valuations than in the past. For investors, their portfolios’ value grew significantly faster which enabled them to raise capital at a quicker pace and sell off portions (or in some cases all) of previously illiquid interests in companies at a higher premium. It was all about who could bid the highest price.

But 2022 is already different – valuations and round sizes are declining, many rounds are being postponed, term sheets are being renegotiated or even pulled and we are likely not even at the bottom yet. This is already being reflected in the secondary market. Jeffries H1 2022 Global Secondary Market Review estimated that the average high bid price for a 2021 secondary deal in venture was 88% of the assets’ value but in 1H 2022, this dropped to 71%.

In such an environment, when prices have adjusted so quickly and capital is no longer as readily available, liquidity through the secondary market, both for investors in companies and LPs in funds, needs to be handled as delicately and thoughtfully as ever. Choosing the right secondary buyer who can act as a long-term investor and value-add partner is now more critical than ever. With this in mind, if you are interested in discussing VC or the secondary market specifically, please don’t hesitate to reach out.