Blog

Blog

April, 2024

We at Value+ possess a vast network within corporates, contributing to our unique positioning. By interacting with corporates worldwide, we gain access to data and insights and receive a wide range of problem statements across different industries. The following is a report on the latest trends in corporate open innovation.

Methodology

Our report draws insights from a dataset encompassing 108 corporates across various sectors, including financial services, automotive, CPG, telecom, energy, manufacturing, and retail. It analyses 143 scouting requests received throughout 2023 and the first quarter of 2024.

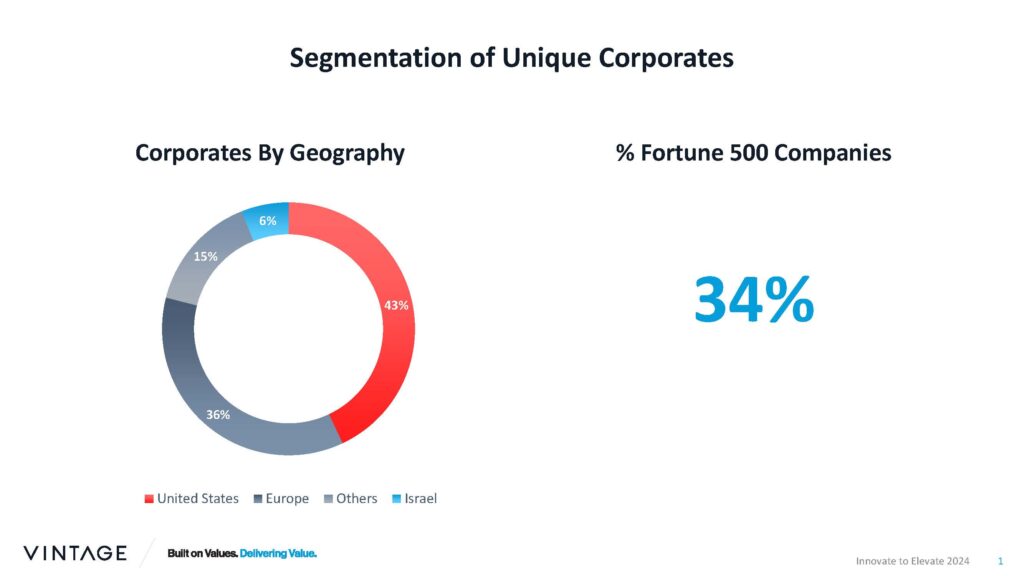

Our corporate network extends globally and is prominent in critical regions such as the US, EU, and Asia. Notably, 34% of our corporate partners are Fortune 500 companies.

On the Startup Front, we’ve included 1200 unique startups from diverse geographies, with 45% originating from the US, 34% from Israel, and 17% from Europe.

Global Trends Analysis

These observations highlight the evolving priorities and preferences within the corporate landscape, shedding light on areas of heightened interest and emerging trends.

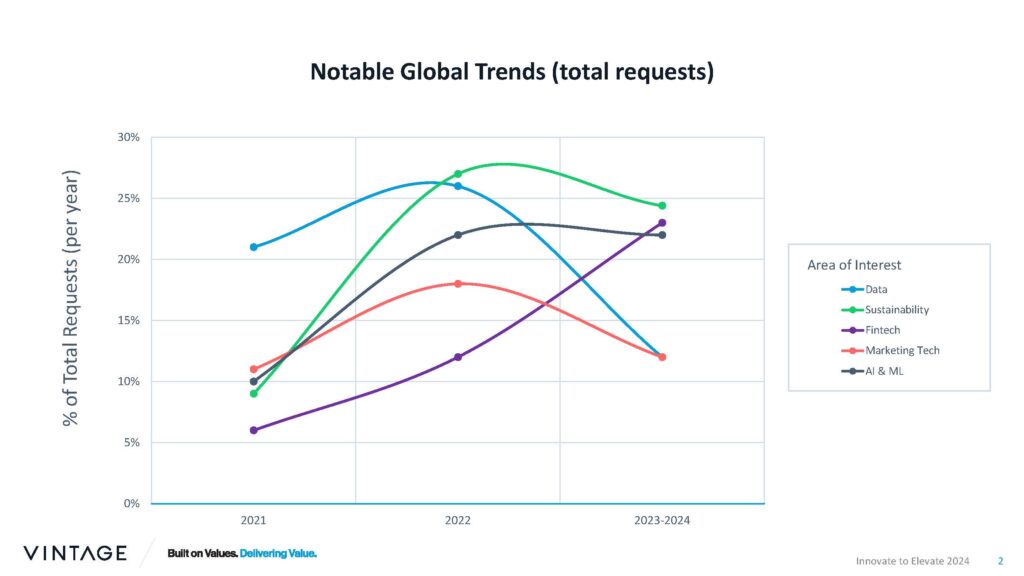

An examination of general trends from 2021 to the present reveals shifts in corporate demand across various domains. Notably, in terms of Sustainability, there has been a stable decrease since the latter half of 2023, following a significant upsurge in 2022 after the implementation of the Climate Change Act 2021 and the Corporate Sustainability Reporting Directive (CSRD).

Conversely, the field of Fintech has witnessed a marked increase in volume and percentage, nearly doubling in prominence. The fact that in industries like retail and utilities, it plays as a growth engine explains why. Integrating services like payment processing diversifies revenue streams while enhancing the customer experience boosts satisfaction and loyalty. It also fosters competitiveness through innovative services and facilitates monetizing valuable consumer data, appealing to various industries. Similarly, there has been a notable uptick in interest surrounding Artificial Intelligence (AI) and Machine Learning (ML), coinciding with a corresponding decline in demand for scouting requests within the more traditional domain of data analytics and marketing technologies.

The top global sustainability trends encompass a range of critical areas, such as ESG platforms, energy management, alternative energy sources, sustainable packaging, and carbon capture. Significantly, there has been a noticeable shift from superficial engagement with green technologies to a more profound integration of sustainability principles within businesses’ core operations. This involves adopting practices that reduce environmental impact, minimize resource consumption, and promote social responsibility throughout the entire value chain. For example, companies invest in renewable energy sources, implementing circular economy models to reduce waste. This trend underscores a broader commitment to fostering sustainability across various sectors, emphasizing substantive actions over mere buzzwords.

In light of recent disruptions like the global pandemic, geopolitical tensions, and natural disasters, there’s been a noticeable uptick in the quest for innovative technological solutions within the supply chain and logistics sector. This increased interest is particularly evident in industries highly attuned to supply chain dynamics, such as automotive and consumer packaged goods (CPG). Key trends influencing the landscape include supply chain automation, improving visibility across the supply chain, utilizing computer vision technologies, implementing robust risk management strategies, and embracing the concept of digital twins to enhance operational efficiency and resilience against disruptions.

The cybersecurity landscape remains ever-dynamic, with significant demand for solutions spanning fraud detection, threat management, identity protection, application security, and incident response. Of particular note is the financial sector’s escalating need for technologies adept at detecting and thwarting fraud attempts. There’s a noticeable shift in corporate outlooks concerning cyber threats, with a recognition that breaches are increasingly inevitable, necessitating robust preparation strategies.

Additionally, we’re witnessing a burgeoning interest in quantum-resistant cryptography spurred by the advancing realm of quantum computing. This proactive stance underscores the importance of staying ahead of emerging technological challenges to safeguard corporate assets and sensitive data.

We also see a shift in perspective from the past. If corporations wanted to protect themselves in the last few years to ensure there wouldn’t be a breach, now their viewpoint has changed a bit. They understand that in the event of a breach, they want to ensure the response is as quick and effective as possible. That is why we see growth in the request for incident response technologies.

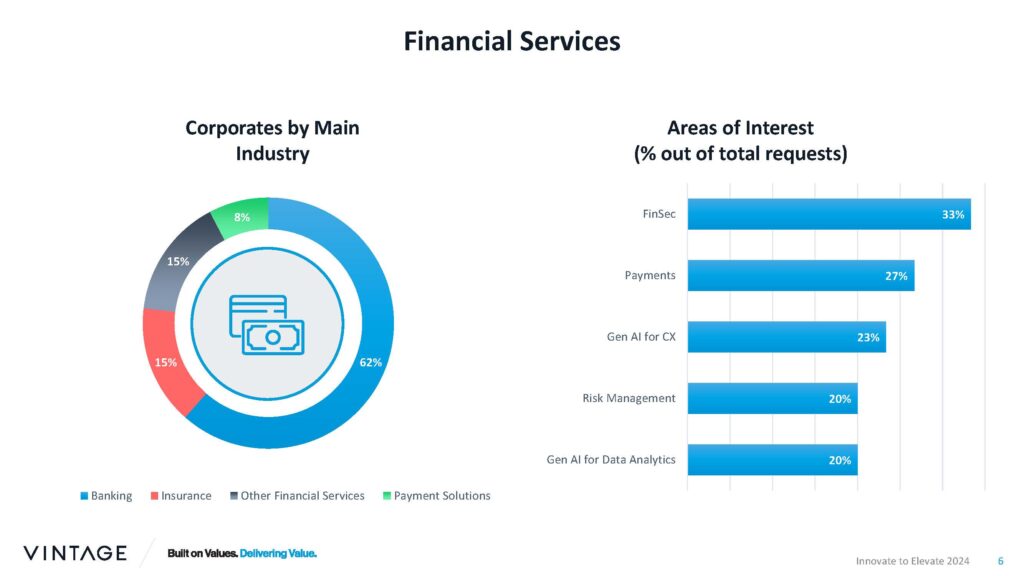

Sector Specific Trends – Financial Services

In the past year, we have primarily engaged with companies within the financial sector, including banks, insurance providers, and payment solutions providers. Among these, key areas of interest, in descending order, encompass Finsec, Payments, Gen AI for customer experience, Gen AI for data analytics, and Risk Management.

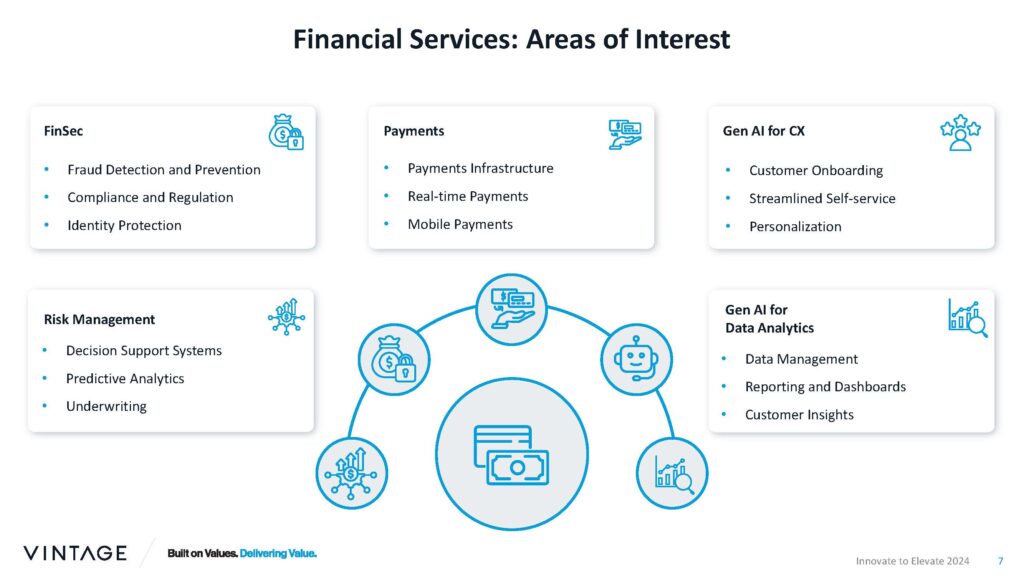

Within Finsec, positioned at the convergence of cybersecurity and fintech, focus areas revolve around Fraud Detection and Prevention, Compliance and Regulation, and Identity Protection.

Payment sector priorities entail implementing real-time payment solutions, supporting mobile banking capabilities, and enhancing payment infrastructure resilience. This also relates to the earlier mention that technology enables new industry players to enter the payments space.

GenAI—As part of the global trend, we see high demand for Gen AI-related technology. We also see “top downs,”— meaning the management of this corporation wants to participate in this revolution and ask for those technologies. Gen AI for consumer experience is a “quick win”—readily available technology that is easy to implement. A good example here can be AI for data on customer call centers, marketing, etc.

On the other hand, the Gen AI tech can do much more for this industry, which has vast databases. Providing insights from this data using AI can help corporates become more efficient, save money, and provide better services and pricing. This process will take time as it requires deepening the core systems of those legacy systems.

Finally, risk management strategies center on deploying decision support systems and predictive analytics to mitigate risks, complemented by IoT-driven real-time data collection on insured assets to strengthen risk assessment capabilities.

How can we help?

Our continuous engagement with emerging technologies, corporates, and startups helps us identify trends shaping corporate innovation efforts. We’ve uncovered key areas of interest and observed noteworthy shifts. From the elevated attention towards fintech and AI to the growing focus on sustainability and supply chain resilience. In the fast-paced business world, these findings can provide a resource to guide decision-making and encourage innovation for established companies and startups.

For tailored analysis to your needs, please contact our team.