Blog

Blog

June, 2022

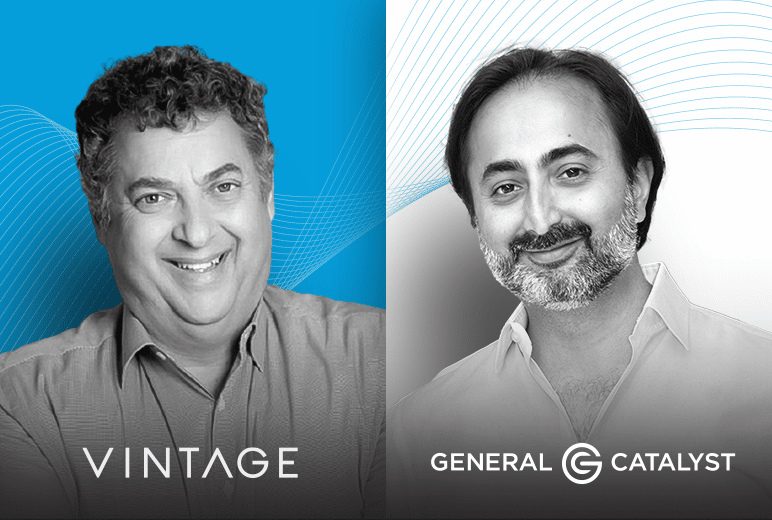

Can VCs generate great shareholder value and value to society at the same time? Hemant from General Catalyst thinks it is possible.

How? The very best investments compound for a long time #stripe and the only businesses that compound are the ones that society allows to compound and then there is interest to society. Building companies with the right mindset.

00-5:25 How Hemant made his way to becoming an investor.

Taking risks – Hemant always reminds him that the entrepreneurial spirit and the ability to take risk is what gets you to success.

5:26 – 8:55 What are “intended consequences” – Is generating profits for your LPs equal to shareholder value? And what does it mean for VCs?

How has the world of healthcare innovation changed in the last 50, 20 years and what is it today?

8:56 –12:59 Healthcare hasn’t gone through dramatic changes – How do we redo the healthcare system?

The fundamental issue with the American healthcare system – Who pays. Who decides, who benefits – those three are different people. So it is fundamentally misaligned businesses which is breaking us.

What if we could design the healthcare system how would it look: what does it need to include?

13:00 –15:57 Is there an opportunity in education investments? What the education system should look like? It is all about learning how to learn. The other part of education is workforce education Guild Education rethinking education benefits develop new skills and be able to navigate through

15:58 –18:20 Climate – what is the role of VCs in doing good? – is it possible to invest in climate and generate revenues for the funds? The #tesla story – how tesla contributed to energy transmission path. The great mindset shift from supply-side innovation to demand-side innovation.