Blog

Blog

November, 2020

Watch the complete Panel here:

The Panel discussed different topics:

• Where does your deal flow come from? How do you make sure you see the best and most relevant deals?

• Do you invest in a specific sector or are you a generalist? What do you think is the right approach?

• What is the level of traction you want to see before making an investment?

• Do you prefer investing as a sole angel or alongside other angels/investors?

• What is the angel’s role other than providing capital? What are the founders expecting to get from him in terms of value add?

• Do you usually make investments that are based on milestones (e.g. prototype, design partners, etc.) or not? In which cases one method is better than the other?

• Looking back at your successful investments – what were the common characteristics of the founders or the startups themselves?

• What are some common characteristics of your least performing investments? What lessons have you learned?

• What is the right number of investments per year an angel should do and what percentage of your wealth goes into venture?

The Arab Angels Club

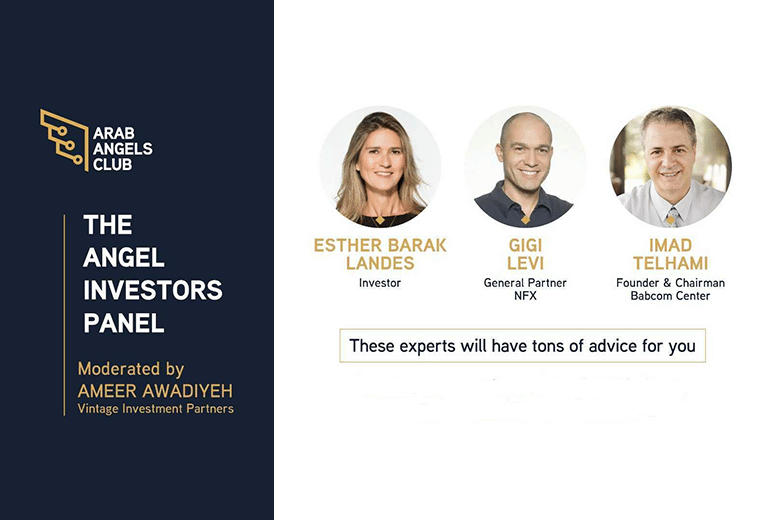

In partnership with the Edmond De Rothschild Foundation, the IDC and Vintage Investment Partners, Hasoub launched the first batch of the “Arab Angels Club” – a ground breaking initiative that aims to create an exclusive community of experienced Arab businesspeople, senior technologists and professionals seeking to enhance their knowledge and network in the world of venture capital and become active angel investors. The first phase, that will be delivered by the IDC through a course that will run from October 2020 till January 2021, aims to enrich the participants’ theoretical background and will touch on different topics including the local ecosystem, business plans, due diligence and others. The second phase of the program, in cooperation with Vintage Investment Partners, will focus on exposing the club members to success stories, industry veterans, trends and best practices in the world of Venture Capital.